Another week of earnings has helped the market close near its highs on Friday, and it looks to open higher Monday as traders and investors alike continue to shovel money into equities.

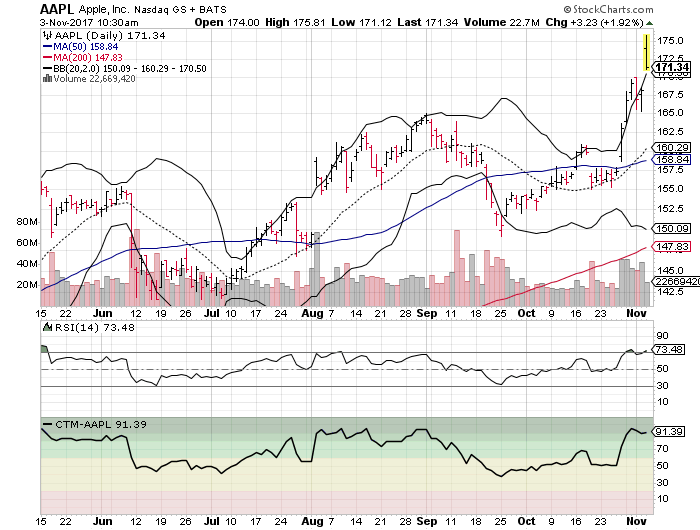

Last week’s earnings results from Apple gave the technology sector another boost in the arm as the stock is trading more than 3% higher in early movement. While the results are positive, there may be a chance to grab the stock on a pullback if history has anything to say about it.

Today’s three big stock charts takes a look at Apple Inc. (NASDAQ:AAPL), General Electric Company (NYSE:GE) and Tesla Inc (NASDAQ:TSLA) as a potential “buy the dip” candidates.

Apple Inc.

With shares trading at their highs and the buzz over the newest of the iPhones hitting a frenzy may prove to be the wrong day to jump on the Apple stock bandwagon. According to our historical tracking, the stock tends to drop an average of around 6% after announcements as traders sell into the strength of the rumor turning to news.

- The latest move takes Apple stock back into a short-term overbought reading of its RSI. As one of the more heavily traded stocks, this indicator tends to nail short-term tops and selling opportunities.

- While the stock is above its top Bollinger Band, the distance between the top and bottom bands suggests that the stock is ready to enter a less volatile trading situation as it reverts to the mean (a fancy term for corrects).

- $162 presents itself as the short-term target and a likely area where traders will buy the dip on Apple. This level represents the stock’s top in September as well as the most recent price where the stock gapped higher on heavy trading volume.

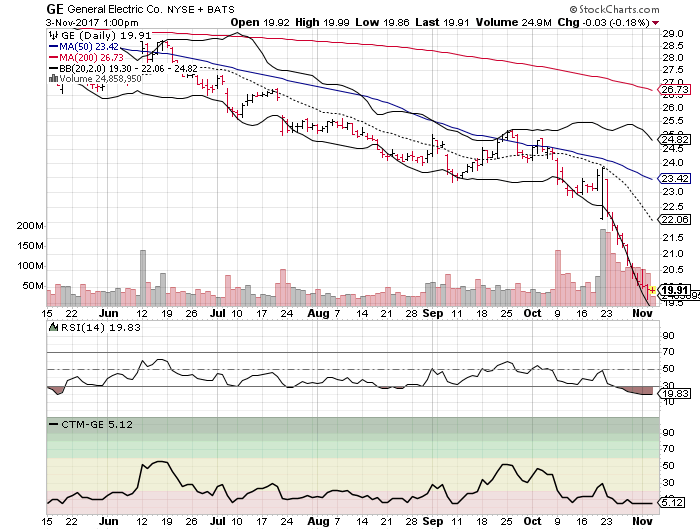

General Electric

Shares of “The General” are battered after the last earnings report weeks ago. Now, the stock is pressing against significant support that should result in a short-term bounce for the stock, but is it a hold from here? According to the charts, the answer is relatively clear.

- Shares of GE are now trolling around the $20 which represents serious round-number technical support potential. We’re likely to see traders defend this price based on the psychological aspect alone.

- GE shares are DEEP into their oversold readings as the current RSI reads 20. Historically, the stock almost always sees a short-term bounce from these type of oversold readings and the current technical support at $20 should help as a catalyst.

- Long-term, GE shares remain a sell as the stock is trading deeper into its bear market trend that was marked in April when the 10-month moving average crossed below the 20-month. Our models target a move into the mid-teens before a long-term bottom may present itself.

Bagikan Berita Ini

0 Response to "3 Big Stock Charts for Monday: Apple Inc., General Electric Company and Tesla Inc"

Post a Comment